- HOME

- POLICY AREA

- Competition Policy

- Large Business Group Regulations

Large Business Group Regulations

Overview

Definition of “Business Group”

A “business group” refers to a group of companies whose operations are under the de facto control of the same person (Article 2-11 of the MRFTA). If the same person is a company, the group includes the same person and one or more companies controlled by that person.

If the same person is not a company, the group includes two or more companies controlled by that person.The KFTC annually designates business groups that are subject to disclosure and business groups that are subject to limitations on cross-shareholding in order to identify entities to which large business group regulations apply.

Rationale behind the introduction of large business group regulations

Excessive concentration of economic power by a few entities undermines free and fair competition, a core element of a market economy, and the effective distribution of resources.

The KFTC enforces large business group regulations to prevent such excessive concentration of economic power and the erosion of market competition, thereby establishing foundations for fair market competition.

Key regulations on large business groups

Prohibition of Cross-Shareholding (Article 21 of the MRFTA)

Cross-shareholding refers to a situation in which two or more independent companies hold shares in each other. A domestic member company of a business group subject to limitations on cross-shareholding is not allowed to acquire or hold shares in a domestic affiliate that has acquired or holds its own shares. This does not apply for six months when cross-shareholding occurs due to a merger of a company, acquisition through the transfer of its all business, or the exercise of security rights or the receipt of an accord and satisfaction.

Upon violation, a company may be subject to remedies, such as the disposal of shares and a penalty surcharge of up to 20% of the amount involved in the violation. The exercise of voting rights in shares of within a group of cross-shareholding companies is suspended from the date of receipt of the order to dispose of shares. Those who have violated the Act shall be subject to criminal sanctions, including imprisonment with labor for up to three years or a fine not exceeding KRW 200M, pursuant to the KFTC’s criminal complaint to the prosecution.

Prohibition of Creating Circular Shareholding (Article 22 of the MRFTA)

Circular shareholding refers to cross-shareholding by three or more companies making circle shaped investments: Company A invests in Company B, which invests in Company C, and then Company C invests in Company A. A domestic member company of a business group subject to limitations on cross-shareholding is not allowed to form a new circular structure or secure additional shareholding that solidifies the existing circular shareholding. This does not apply to ordinary corporate restructuring activities, such as the reorganization of business structures (e.g., mergers or divisions) and the legitimate exercise of rights (e.g., the exercise of security rights or the receipt of an accord and satisfaction).

However, circular shareholding must be eliminated within a grace period of six months to three years, depending on the reasons.Upon violation, a company may be subject to remedies, such as the disposal of shares and a penalty surcharge of up to 20% of the amount involved in the violation. The exercise of voting rights in shares resulting from new circular shareholding is suspended from the date of receipt of the order to dispose of shares. Those who has violated the Act may be imposed with criminal sanctions such as imprisonment with labor for up to three years or a fine not exceeding KRW 200M, pursuant to the KFTC’s criminal complaint to the prosecution

Prohibition of Debt Guarantees for Affiliates (Article 24 of the MRFTA)

A debt guarantee under the MRFTA refers to a guarantee provided by a member company of a business group for credits (loans, and guarantees or the assumption of corporate debts) granted by domestic financial institutions (e.g., banks and insurance companies) to another domestic affiliate.

Domestic member companies of a business group subject to limitations on cross-shareholding are prohibited from providing debt guarantees to domestic affiliates. The prohibition of debt guarantees for affiliates was introduced to lay a foundation for fair competition in corporate financing and reduce overall systemic risks within business groups. However, debt guarantees may be exceptionally allowed when they are necessary for industrial rationalization and the enhancement of national competitiveness.

Also, the MRFTA regulates debt guarantees or assumptions intended to circumvent the prohibition of debt guarantees for affiliates within or between business groups subject to cross-shareholding limits. This includes cumulative debt assumption, where one affiliate assumes another’s debt under the same terms and conditions without releasing the original debtor from its existing debt; and cross-debt guarantees, where debt guarantees are exchanged between affiliates belonging to different business groups.

Upon violation, the KFTC may impose remedies and a penalty surcharge of up to 20% of the amount involved in the violation. Those who has violated the Act may be imposed with criminal sanctions such as imprisonment with labor for up to three years or a fine not exceeding KRW 200M, pursuant to the KFTC’s criminal complaint to the prosecution.

Restrictions on Voting Rights Held by Financial Companies, Insurance Companies, and Public Interest Corporations (Article 25 of the MRFTA)

No domestic member company of a business group subject to limitations on cross-shareholding that engages in financial or insurance business shall exercise its voting rights for the shares it has acquired or owned in its domestic affiliates. However, financial/insurance companies can exercise their voting rights without restrictions in cases: where they acquire or own the relevant shares to engage in financial/insurance business; and where they obtained approval under the relevant laws (e.g., the Insurance Business Act). When a resolution is adopted on particular matters—appointment or dismissal of an executive officer, amendment to the articles of incorporations, and an affiliate’s merger with or transfer of its business to a company not belonging to the business group—financial/insurance companies can exercise their voting rights for up to 15% of the total shares in their affiliates, including shares owned by related parties.

Public interest corporations can exercise voting rights when they own all shares in a domestic affiliate, or they can exercise voting rights for up to 15% of the total shares in their affiliates, including shares owned by related parties, on specific resolutions such as the appointment or dismissal of an executive officer, amendments to the articles of incorporation, and an affiliate’s merger with or transfer of its business to a company outside the business group.

Upon violation, the KFTC may impose remedies. Those who has violated the Act may be imposed with criminal sanctions such as imprisonment with labor for up to three years or a fine not exceeding KRW 200M, pursuant to the KFTC’s criminal complaint to the prosecution.

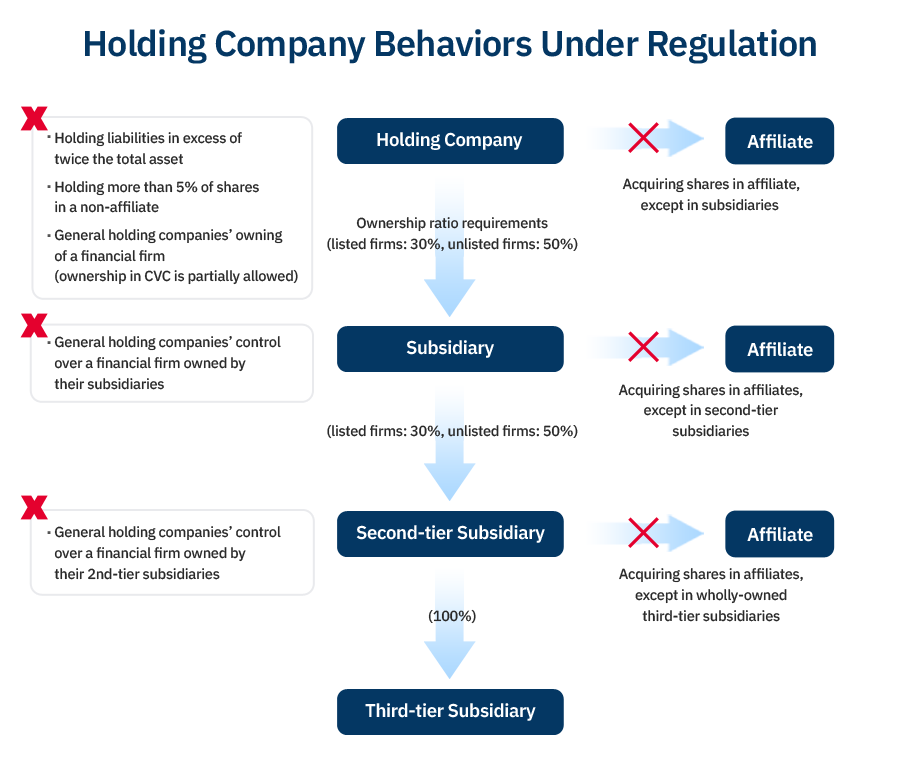

Regulations for Holding Companies (Article 17 and 18 of the MRFTA)

The term “holding company” refers to a company whose main business is to control the business of a company through ownership of shares. The MRFTA defines a holding company as one that holds total assets of at least KRW 500B (KRW 30B for a venture holding company) and owns subsidiary shares valued no less than 50% of the total assets of its subsidiaries.

The MRFTA imposes restrictions on the behaviors of holding companies, based on ownership tiers/ratios and other factors, to curb the excessive extension of dominance that may occur in a holding company system and maintain a simple and transparent ownership structure.

Upon violation, the KFTC may impose remedies and a penalty surcharge of up to 20% of the amount involved in the violation. Those who has violated the Act may be imposed with criminal sanctions such as imprisonment with labor for up to three years or a fine not exceeding KRW 200M, pursuant to the KFTC’s criminal complaint to the prosecution.

Framework for Corporate Disclosure

| Type | Details subject to disclosure | Deadline/Cycle |

|---|---|---|

| Resolutions by board of directors on large-scale inter-affiliate transactions |

|

Within 3 business day for listed companies or 7 business days for unlisted companies from the date of a resolution. |

| Any significant change in unlisted companies subject to disclosure statement requirements |

|

Within 7 business days from the date of such change(Quarterly for changes in major shareholders) |

| Current status of business groups |

|

Yearly (in late May) |

|

Quarterly | |

Upon violation, the KFTC may impose remedies requiring the fulfilment of disclosure requirements or the amendment of disclosure reports. It may also impose a penalty surcharge of up to 100M on companies and 10M on executives and employees

Resolutions by Board of Directors on Largescale Inter-affiliate Transactions and Disclosure Thereof (Article 26 of the MRFTA)

Where a member company of a business group subject to disclosure intends to offer funds, securities, assets, and goods and services to or trade them with a related party, it shall disclose such offering or trading after the resolution by the board of directors within 1 business day for listed companies or 7 business days for unlisted companies from the date of a resolution.

Disclosure of Material Facts by Unlisted Companies (Article 27 of the MRFTA)

An unlisted company within a business group subject to disclosure shall disclose any significant changes regarding

(1) corporate and ownership governance, (2) financial structure, and (3) management within 7 business days from the date of such change.

Disclosure of Current Status of Business Groups (Article 28 of the MRFTA)

A member company of a business group subject to disclosure shall disclose the current status of the business group regarding general matters, executives and the bord of directors, shareholdings, transactions with related parties, circular shareholding, the holding company, a financial/insurance company’s exercise of voting rights in their affiliates, etc. Upon violation, the KFTC may impose remedies requiring the fulfilment of disclosure requirements or the amendment of disclosure reports. It may also impose a penalty surcharge of up to 100M on companies and 10M on executives and employees.